When it comes to taxes, the first month that pops into most people’s minds is April – but the most important tax month of the year should be November or December.

Why?

Because thinking about taxes before the year starts is the only way to engage proactive planning and achieve tax efficiency.

If you haven’t already scheduled your end-of-year tax planning meeting, here are 5 reasons why you should.

Identify tax saving opportunities

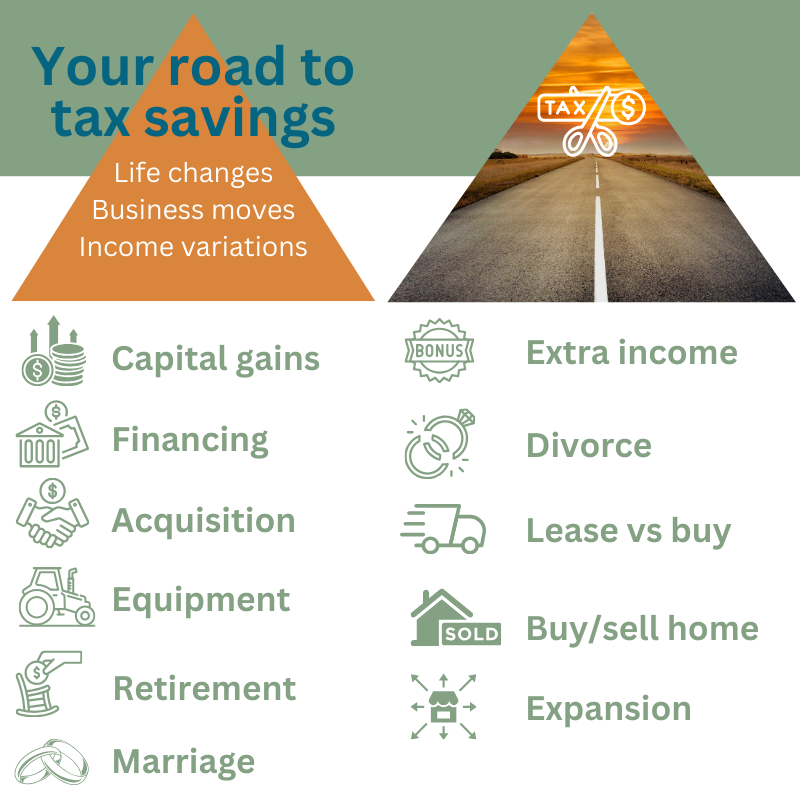

With so many moving pieces making up your financial life, it’s easy to miss tax saving opportunities before it’s too late – especially when the opportunity was more about the timing than the action itself.

Planning ahead is the best way to implement strategic moves that can minimize or maximize the impact of big events and major decisions.

Gain clarity and peace of mind

Why spend all year in the dark surrounding your tax burden when you can know what you’ll owe up front?

Clarity into your tax reality delivers freedom from worry or stress.

Avoid surprises

Prevent the sticker shock of discovering big changes to your tax liability right before taxes are due. Even when there’s nothing you can do to lower your bill, it’s better to know ahead of time when an event will drastically increase your tax burden.

Plan and budget cash accordingly

Knowing how much you’ll owe (and when) simplifies the process of budgeting cash for estimated tax payments for the coming year.

Allocating a smart strategy for how you will pay your tax bill is just as important as doing what you can to minimize the bill itself.

Stay compliant

Tax laws change. Meeting with an expert who knows your unique situation is the fastest way to get up to speed on the new laws that affect you.

How does it work?

Key features of Accountability Services’ Tax Planning Meeting:

- Personalized consultation including a detailed review of your financial situation to identify tax saving opportunities and how to navigate upcoming life events in the most tax efficient way

- Strategic advice and insights into advanced tax planning techniques for maximum savings

- Proactive planning to anticipate future tax events and create a forward-looking plan

- Ensure compliance with current tax laws to avoid penalties

Scheduling an end-of-year tax planning meeting

- Email masterplan@accountabilityservices.com to engage a meeting and book a time

- Complete our tax planning questionnaire at least 2 weeks before your appointment

- Set aside time to attend the meeting