The Financial Crimes Enforcement Network (FinCEN), a bureau of the U.S. Department of the Treasury, has announced the implementation of a new reporting requirement beginning on January 1, 2024.

Many companies will be required to submit beneficial ownership information (BOI). Beneficial owners are the individuals who own or control the company.

What is the purpose of the new requirement?

The bipartisan Corporate Transparency Act of 2021 was passed to make it more difficult for bad actors to hide or benefit from ill-gotten gains through shell companies or other opaque ownership structures.

Requiring companies to identify beneficial owners makes it easier for the federal government to crack down on both domestic and international companies that are breaking financial laws.

Exempt companies

Not all companies will be required to report. 23 types of publicly traded companies meeting specified requirements, many nonprofits, and certain large operating companies will be exempt from filing.

See the list of exempt companies here.

![]()

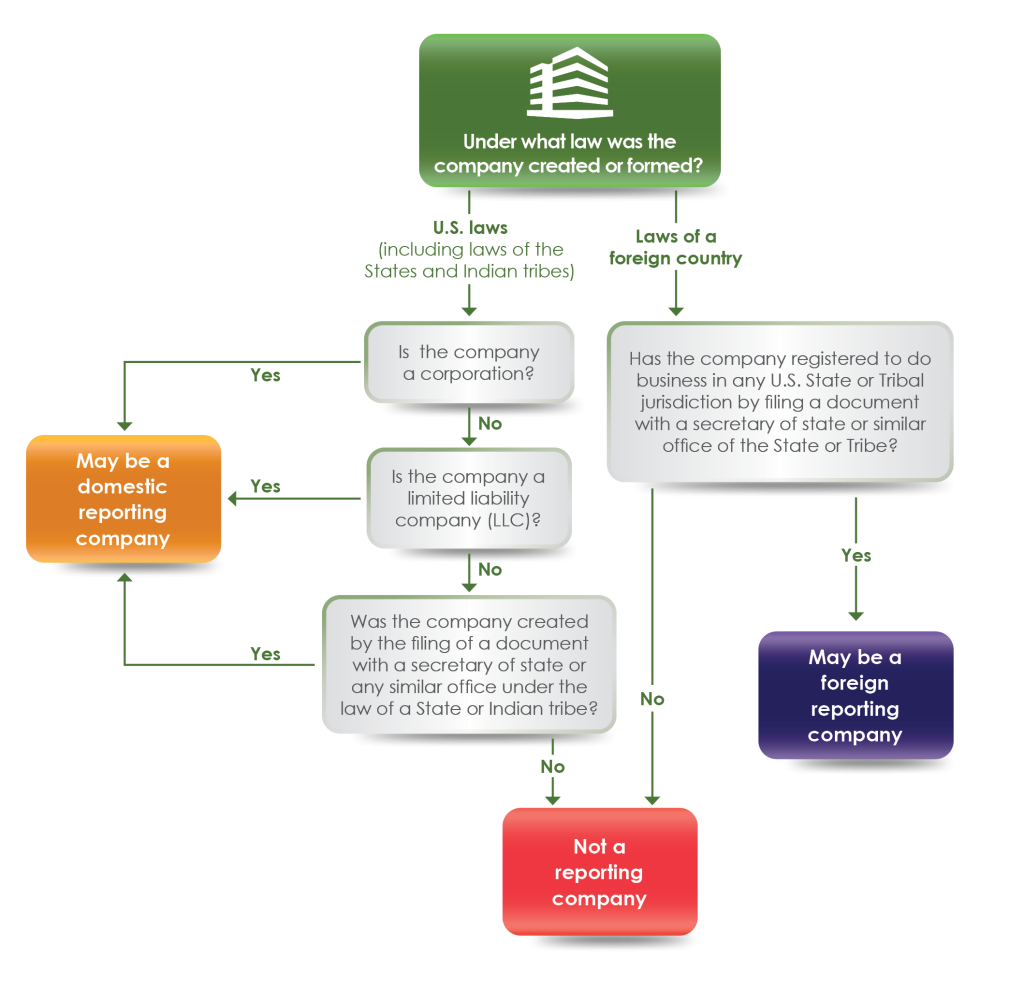

Note: Companies that were NOT created by filing a document with the WA Secretary of State are not a reporting company and will not need to file with FinCEN. (See infographic below)

*Image sourced from https://www.fincen.gov/boi-faqs (Financial Crimes Enforcement Network)

When and how to file

FinCEN is not currently accepting BOI reporting information. A secure electronic filing system will be available at fincen.gov/boi from January 1, 2024. There will be no fee to file.

If you would like assistance handling the new requirement, Accountability Services will be happy to engage and handle it on your behalf.

For more information

- Read BOI reporting FAQs

- Download FinCEN’s Small Business Entity Compliance Guide for the full details on Beneficial Ownership Information reporting requirements