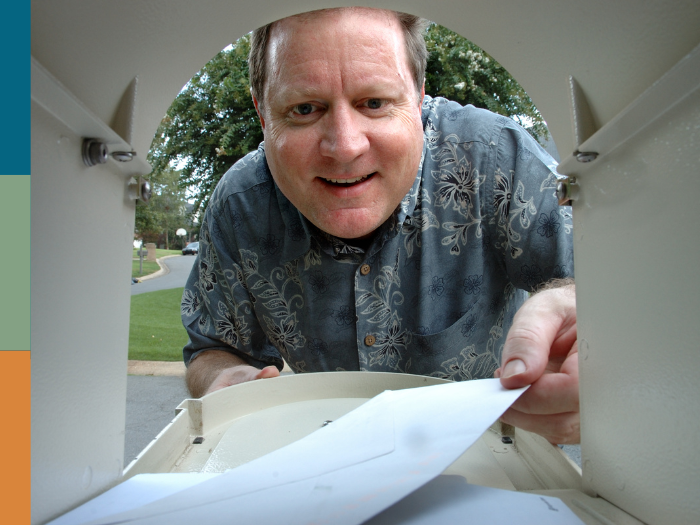

A letter from the Internal Revenue Service is just about the last thing you want to find in your mailbox – but seeing the letters I-R-S on the envelope isn’t necessarily cause for having heart palpitations.

It’s important to remember that the IRS only contacts taxpayers via mailed correspondence to initiate a new communication. They will never email you and will only call you over the phone after prior written contact.

So the letter? It might be no big deal. This is just how the IRS does business, through the snail mail!

Here’s how to know for sure.

Read the letter carefully and thoroughly

The first step is to read the letter from front to back to find out why the IRS is contacting you, what action they are requesting on your part, and when the deadline is for completing this requested action.

You might find it’s something as simple as requesting further verification of your identity, or simply a reminder of your remaining balance of taxes owed.

If the subject matter is serious, by all means escalate your response – but if it’s not, there’s no reason to get worked up over an issue that can be easily resolved or requires no action at all.

Look up the IRS notification code

Every letter you receive from the IRS will include a code that specifies exactly what type of notification you have received. Do a quick Google search or use the IRS notice & letter lookup tool to determine the severity.

Look for “red flag” phrases

Most IRS notifications can be resolved quickly and easily. It’s rare that you will receive a surprise letter from the IRS that is serious in nature. Typically, the serious letters only come after months or years of failing to resolve an issue you already know about.

Do, however, consider the letter serious if you see one or more of the following phrases: final notice, levy, hearing, lien, deficiency. These words indicate that the IRS may seize or place a lien against your property.

Here are some of the more serious IRS letters that do require immediate attention and may lead to the seizing of your property or other legal action:

- CP504 – Final notice of intent to levy and notice of your right to a hearing

- LT11/Letter 1058 – Notice of intent to levy and your right to a hearing

- Letter 3219 – Notice of deficiency

- Letter 531 – Final notice of deficiency

- CP90/CP91 – Final notice before levy on social security benefits or other income

- Letter 668 – Federal tax lien

- CP2000 – Proposed changes to your return

- Letter 227 – Acknowledgment of unpaid payroll taxes

Less serious IRS notifications

Not every IRS letter informing you that you owe taxes or that your return has been changed are serious.

- A balance due notice (CP14) is quickly resolved by making a payment

- CP12 notifies the taxpayer about minor changes to their return that result in a refund or slight adjustment in balance due

- CP49 simply informs the taxpayer that a tax overpayment has been applied to a different outstanding tax debt

- CP2501 is a request to clarify a discrepancy on your return due to a mismatch in your reported income or deductions

Don’t ignore letters from the IRS

All that said, even less serious notifications do often require a response or action on your part. This is why it’s important to read each letter carefully to figure out exactly what the IRS wants you to do, and when they need you to do it by.

Use your best judgment to determine the severity of the situation but don’t automatically presume the sky is falling just because it’s the IRS. The IRS always prefers simple resolutions over court cases and legal action.

Of course, when the situation is dire, don’t wait to reach out to us for professional guidance and advice. That’s what we’re here for.