In any professional services business, it’s virtually impossible to be an expert at everything. So, when you run a business as tricky as a SaaS enterprise, choosing a generalist CPA firm could lead to knowledge gaps where you need expertise most.

With My SaaS Advisor, you can rest assured that your CPA and advisory team have worked with SaaS companies before. They understand the unique financial challenges you’re facing and have the specialized knowledge needed to deliver the services that will drive your business forward.

Expertise in SaaS-specific accounting rules

SaaS companies operate under unique financial models, where subscription revenue, deferred revenue, and complex pricing structures are common. A SaaS CPA understands these intricacies and can help you prepare financial statements that accurately reflect the numbers potential investors are looking for.

Stay on top of ASC 606 accounting standards:

- Recognize revenue at the right time

- Manage deferred revenue properly

- Accurately account for monthly, quarterly, and annual subscriptions

Minimize tax liability and stay out of trouble

Tax laws for SaaS companies can be tricky, especially if you operate across multiple states or internationally. An accounting and advisory firm that specializes in SaaS taxes can help you:

- Manage sales tax compliance across multiple jurisdictions

- Claim every available R&D tax credit

- Put together a robust international tax strategy

Detailed financial forecasts, budgets, and models to guide decision-making

Acquiring customers is just one aspect of scaling a SaaS business.

You need solid financial plans to make sure you can sustain growth while managing your company’s fiscal health.

Prepare to exit in style

SaaS founders are more likely to be looking for an early exit compared to other types of entrepreneurs, either through a sale, merger, or IPO. A SaaS CPA plays an essential role in preparing your company for that exit and maximize valuation for your biggest payout.

- Identify key metrics that impact company valuation

- Structure the transaction effectively to minimize taxes

Guidance for exit strategy and valuation maximization are particularly important for SaaS companies that intend to sell before the business is turning a substantial profit.

Improve decision making with data-driven insights

My SaaS Advisor has invested in powerful analytical tools to put your company’s data to work for you.

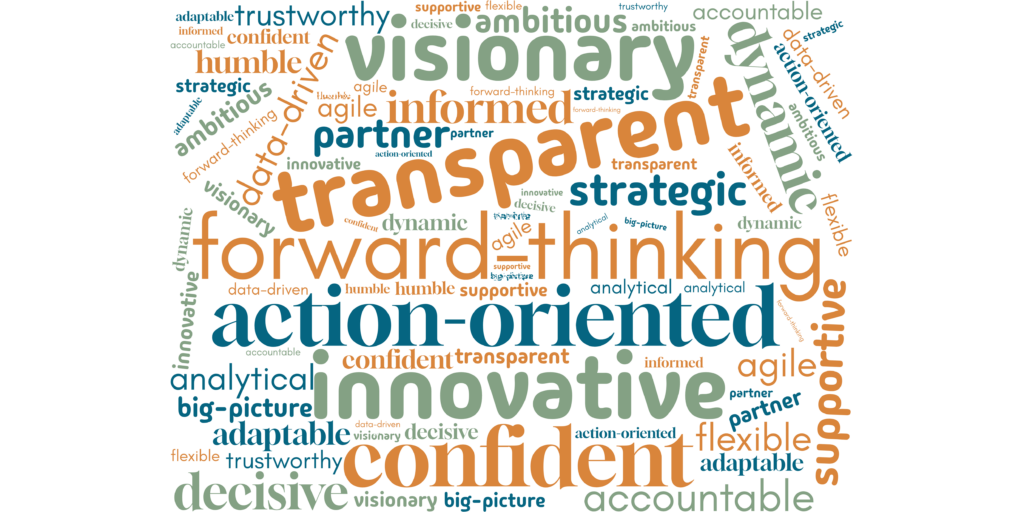

SaaS CPAs bring an innovation mindset to the table

Finding the right cultural fit for your advisory team is a big deal. Just like you hire employees and contractors who are a great match for your organization, the same process should apply to choosing professional partners, too.

To find out if we’re the right fit to be your SaaS CPA, schedule a FREE 30-minute Discovery Meeting.